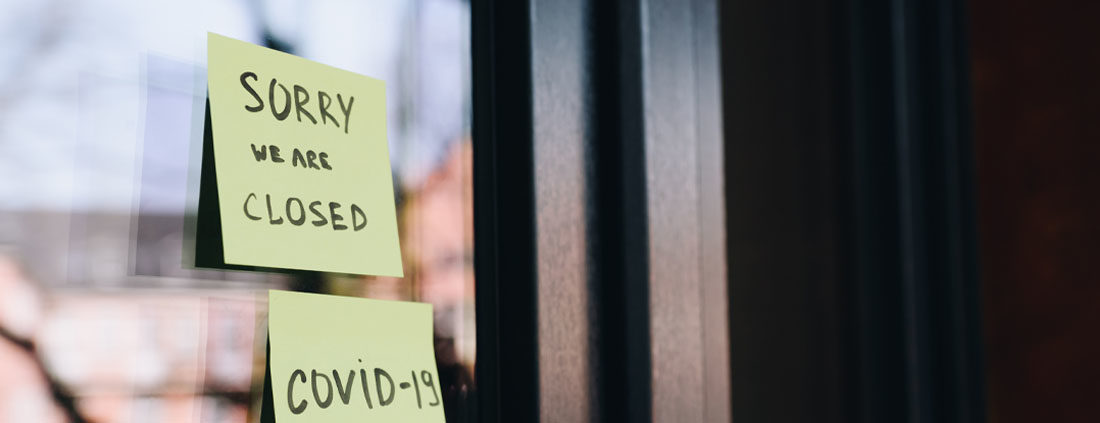

Commercial tenancies and the Government’s proposal aimed to ease the burden on businesses impacted by current restrictions

As COVID-19 alert levels continue to fluctuate across New Zealand, many businesses are feeling the cost of being unable to operate. Restrictions on movement are impacting income streams and placing significant financial burden on some businesses. As a result, many business owners have expressed concern over their inability to meet rental costs.

To ease this burden, the Government has proposed changes to commercial tenancies via the COVID-19 Response (Management Measures) Legislation Bill (the Bill). The Bill aims to amend the Property Law Act 2007 to include a clause in commercial leases requiring a ‘fair proportion’ of rent and outgoings to cease to be paid where a tenant has been unable to access all or any part of their premises due to an epidemic. This will require landlords and tenants to reach agreement on a reduced amount of rent payable by the tenant for the affected period.

Where landlords and tenants are unable to reach agreement on what is a ‘fair proportion’, the dispute will be referred to arbitration where an appropriate outcome will be decided on. Requests for clarity on what is ‘fair’ in order to avoid such disputes have been made, including by the NZ Law Society. There have also been calls to include mediation as a step prior to arbitration to avoid costly disputes processes.

It is important to note that landlords and tenants have the option to agree that the proposed clause does not apply, in which case rent would be paid by the tenant as previously agreed.

The proposed change will not apply to lease agreements that include a ’no access in an emergency’ clause that already covers a health crisis. This clause is standard in the ADLS Deed of Lease which is widely used for lease agreements.

The Bill had its first reading on 29 September 2021, and it is widely expected the Bill will be passed quickly. It will take retrospective effect from 28 September 2021, meaning any rental payments from this date may be affected by the new law.

If you have any questions about the proposed changes and how they may impact your lease agreements, please contact us and we will be happy to advise.