Return of the Brains Trust

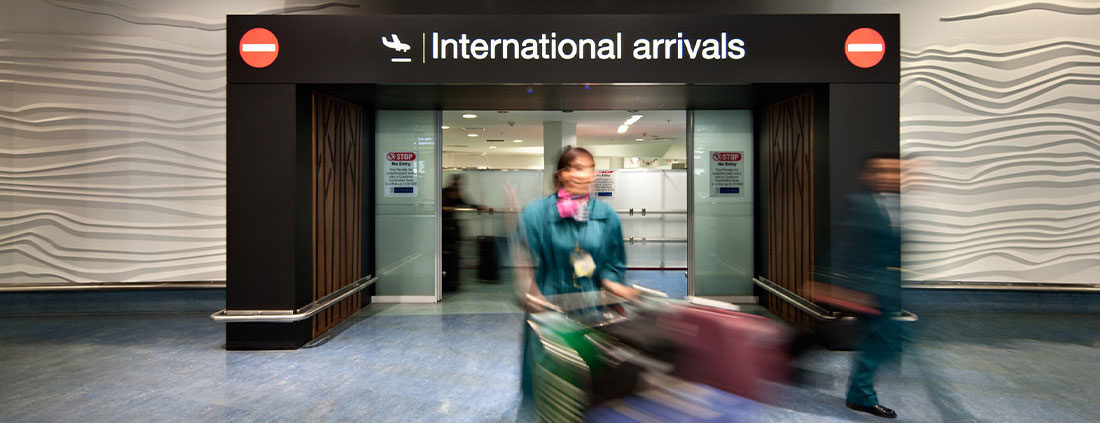

First published in The Profit. Written by Christine Symes. If there is a silver lining when talking about the global COVID-19 pandemic, it has to be the return to our shores of thousands of highly skilled Kiwis. For years, New Zealand has been a casualty of what has been termed ‘brain drain’, as highly qualified New Zealanders left in search of opportunities aboard. Recent figures show that over 50,000 expats have already returned home, with predictions that as many as 500,000 are likely...